Wellington-founded

start-up Projectworks – a maker of professional services automation software – has raised US$5 million ($8.2m) at a $100m valuation. The funds will be used to expand its North American beach head.

United States-focused expansion is already under way. In April, the firm named Silicon Valley-based tech veteran Mark Orttung as its chief executive.

At the same time, Projectworks has shifted its incorporation from New Zealand to the US.

The new funds will be used, in part, “to build out a Silicon Valley-based product and engineering team”, Orttung says.

The raise follows a $3.5m seed round in April 2022 – a time when founders Julian Clarke, Matthew Hayter and Doug Taylor were already back in their Wellington office fulltime, unfashionable ahead of the trend.

The Series A round was led by Bridgewest Group (which is based in Miami but has an outpost in New Zealand that scouts local talent and partners with Callaghan Innovation on its Technology Incubator programme), with contributions from Orttung and existing shareholders including local venture capital firm Punakaiki Fund (which also chipped in $2m to the seed round) and the founders.

Why a US CEO and R&D centre?

Orttung has already hired four people in the Bay Area and three in Seattle, including AI (artificial intelligence) experts. His main criterion is that new hires are on the West Coast, for daytime overlap with New Zealand. More will follow. “But we’re growing our presence in Wellington, too. The plan is to grow both.”

Twenty to 30 staff will be added to the team in the capital this year, on top of the existing 40.

Still, why shift company registration to the US, and develop a software engineering team centred around the not-so-cheap Silicon Valley?

“Access to capital,” Orttung says.

“A lot of the US investors are looking for a US company.”

“And the ability to attract talent.”

Fabled esops

“The way stock options work if you’re a US company is a little different than if you’re a New Zealand company,” Orttung adds. Here, unrealised gains on employ stock ownership plans (esops) are taxed – robbing start-ups of a key mechanism to attract and keep talent.

Technology Minister Judith Collins made a campaign-trail promise to reform the esop tax rules – though she also warned the policy would take time. The omnibus Taxation (Annual Rates for 2024−25, Emergency Response, and Remedial Measures) Bill, which had its first reading on August 26, includes provisions for lifting the maximum value of shares offered to employees under the scheme from $5000 to $7500 a year, and raising the maximum discount an employer can provide on the market value of those shares from $2000 to $3000. The bill has yet to have its second reading and Select Committee referral. “This is the first step towards meeting our commitment of supporting startups by looking at changes to the tax system,” Collins said.

What drew Orttung to Projectworks?

The new chief executive was previously head of a consultancy firm called Nexient, bought by Japan’s NTT and rebranded as Launch by NTT, with Orttung agreeing to stay on a while to help with the transition.

Before that, he was president and COO of financial operations platform Bill.com.

“At Nexient, we looked for a platform to run our company on, and none of them were any good,” he says. “We had a saying ‘life’s too short for crappy software, but we found a lot of crappy PSA [professional services automation] software,” he says.

Then he came across Projectworks.

“It has great user experience and great functionality because it was built for consultancies by people who were from a consultancy.” Before co-founding Projectworks, Clarke, Hayter and Taylor worked together at Provoke Solutions. He met Hayter and Taylor and told them he liked their product – and that post-Nexient’s takeover, he was also looking for his next gig.

AI: Hype v usability

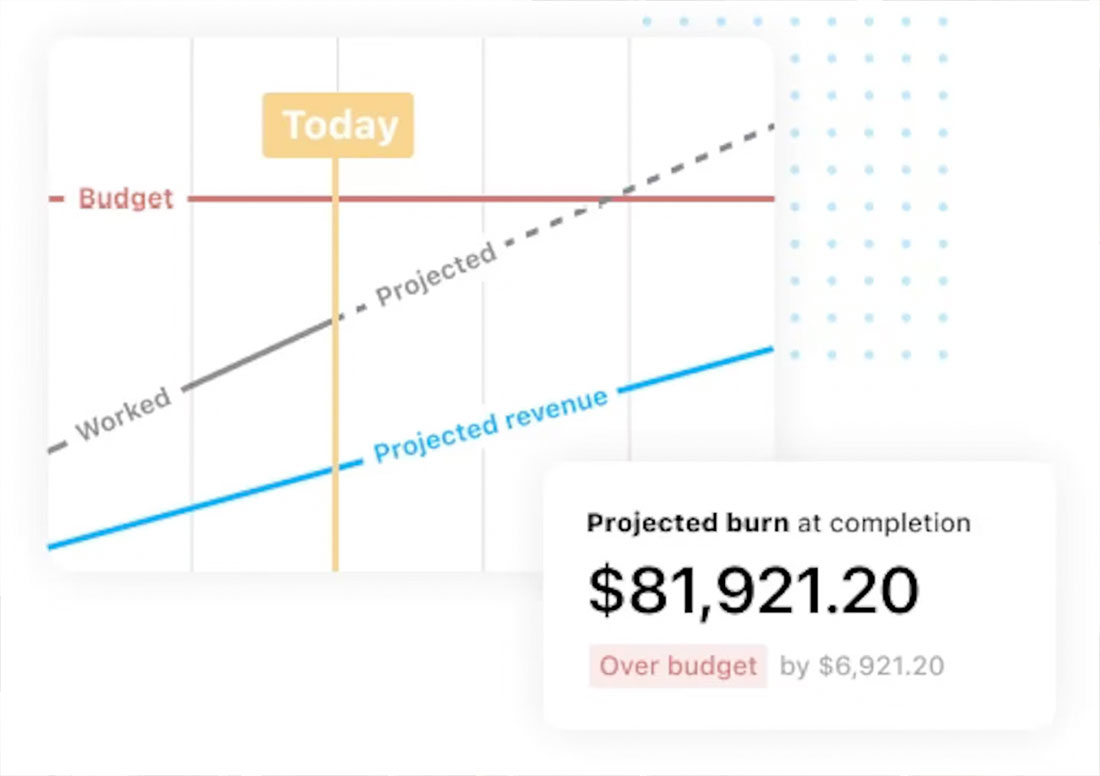

After Projectworks’ seed raise, Hayter pitched his firm’s cloud-based software as more nimble than its legacy competition. The start-up already promised to help you “Keep people busy without burning them out” and “Know before you blow past your client’s budget”.

It included several features sometimes found in different software – timesheet, resource planning, revenue forecasting, and expense management – in an all-in-one interface. There was more of an emphasis on keeping it “crisp and simple” than the traditional alternatives – and being cheaper, to boot.

Still, there was room for improvement.

The $3.5m seed raise was earmarked for implementing a backlog of wishlist features, including some based on artificial intelligence.

Projectworks, which integrates with Xero, offers features including time-tracking, expense and resource tracking and budget forecastiing. It costs $40 per user per month, or $36 per month if paid annually. One of the AI tools would focus on spotting employee burnout before it happens by analysing a range of metrics, which couldinclude simply how long they take to fill in a timesheet.